salt tax deduction limit

New limits for SALT tax write off. Professional tax help with the SALT deduction is also particularly useful as changes to how the SALT deduction is calculated and its limit may be ahead.

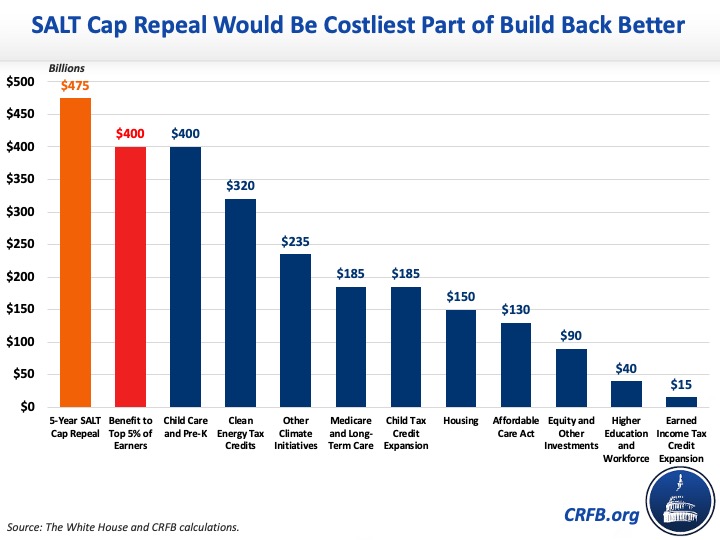

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

There was previously no limit.

. The History of the SALT Deduction. The TCJA limited the SALT deduction available to individual taxpayers. However the Tax Cuts and Jobs Act TCJA created a 10000 limit on the deduction disproportionately affecting higher-income earners in high-tax states.

The Tax Cuts and Jobs Act imposed a 10000 limit on the SALT deduction so regardless of how much you actually pay in state and local taxes youre only. Critics argue that the SALT deduction is merely a tax loophole for the wealthy. Its currently limited to 10000.

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly. There is talk that the SALT deduction limit will be increased from 10000 to 70000 as part of the Build Back Better Plan - this bill has not been signed into law. We will update this page if it is made official.

The federal tax reform law passed on Dec. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. If you live in a state that recognizes community property ownership determine which spouse has legal ownership of the property in question.

Starting with the 2018 tax year the deduction was limited to 10000 for state and local income taxes paid. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. This will leave some high-income filers with a higher tax bill. Definition This deduction is a below-the-line tax deduction only available to taxpayers who itemize Its only available to taxpayers who have eligible state and local taxes to deduct.

Because of the limit however the taxpayers SALT deduction is only 10000. The SALT deduction has been a part of our federal income tax since 1913. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

The current 2017 law changes are set to. Starting with the 2018 tax year the maximum SALT deduction became 10000. Prior to the TCJA.

In 2017 a 10000 ceiling on the previously unlimited SALT deduction was enacted and made applicable for tax years beginning in 2018 and continuing through 2025. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. Under the SALT Act people making less than 400000 would once again be permitted to deduct all state and local taxes on their federal income tax returns provided they itemize their deductions.

The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. For spouses that file separate tax returns the SALT deduction is limited to 5000 per person. State and local tax SALT deduction.

The limit however is scheduled to expire on December 31 2025 when most of the individual tax changes in the TCJA are set to expire. 54 rows As President Joe Biden and policymakers in Congress consider changes in tax policy over the coming year the fate of the 10000 state and local tax SALT deduction cap will be an ongoing part of the policy debate. Income taxes sales taxes personal property taxes and certain real property taxes are eligible for the SALT deduction 1.

The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill. This allowed taxpayers to deduct as many state and local taxes from their federal income. As discussed in Part I of this article at least 22 states have adopted a pass-through entity taxor PTETelection for small business owner taxpayers seeking to avoid the 10000 federal deduction limit for state and local taxes.

The limit is also important to know because the 2021 standard deduction is 12550 for single filers and 12950 in 2022. Most state PTET elections follow the standard workaround formula for the SALT cap which was introduced under the 2017 Tax. 52 rows The SALT deduction allows you to deduct your payments for property.

This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples filing separately. Spouses and the State and Local Tax Deduction Spouses Filing Separately. Theres now a cap on your SALT deduction.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

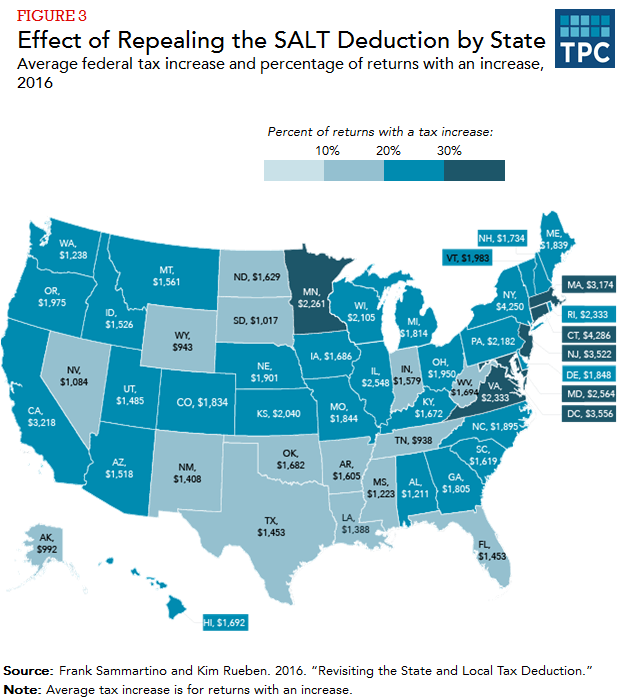

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

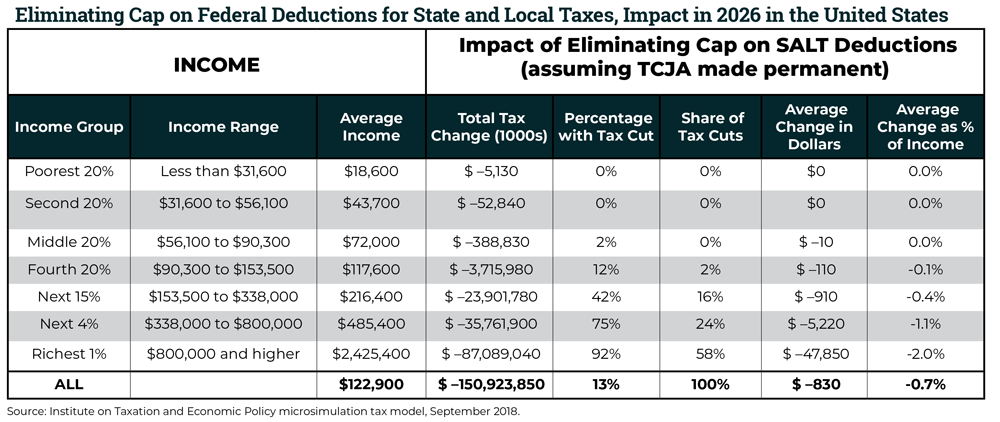

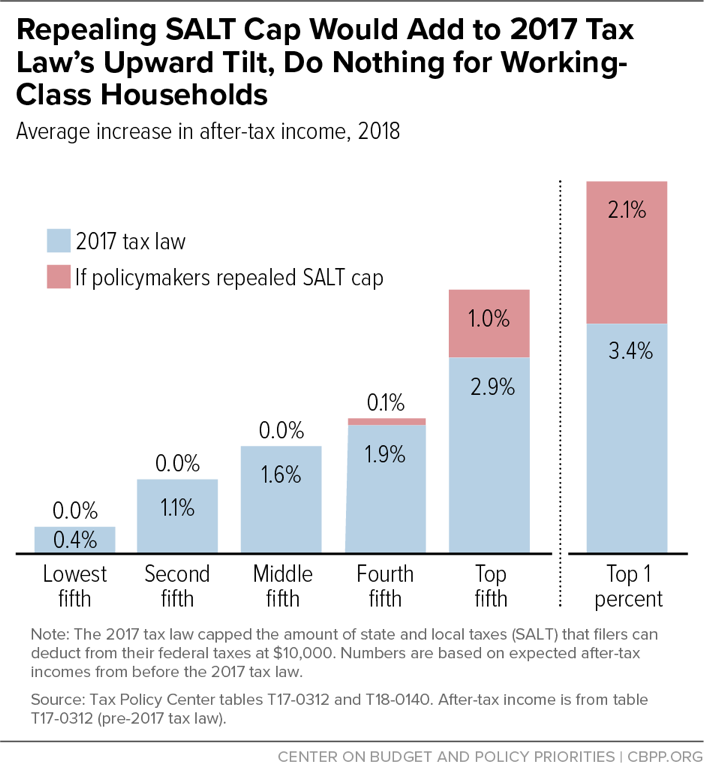

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Lawmakers Continue Fight Against Salt Deduction Limits Don T Mess With Taxes

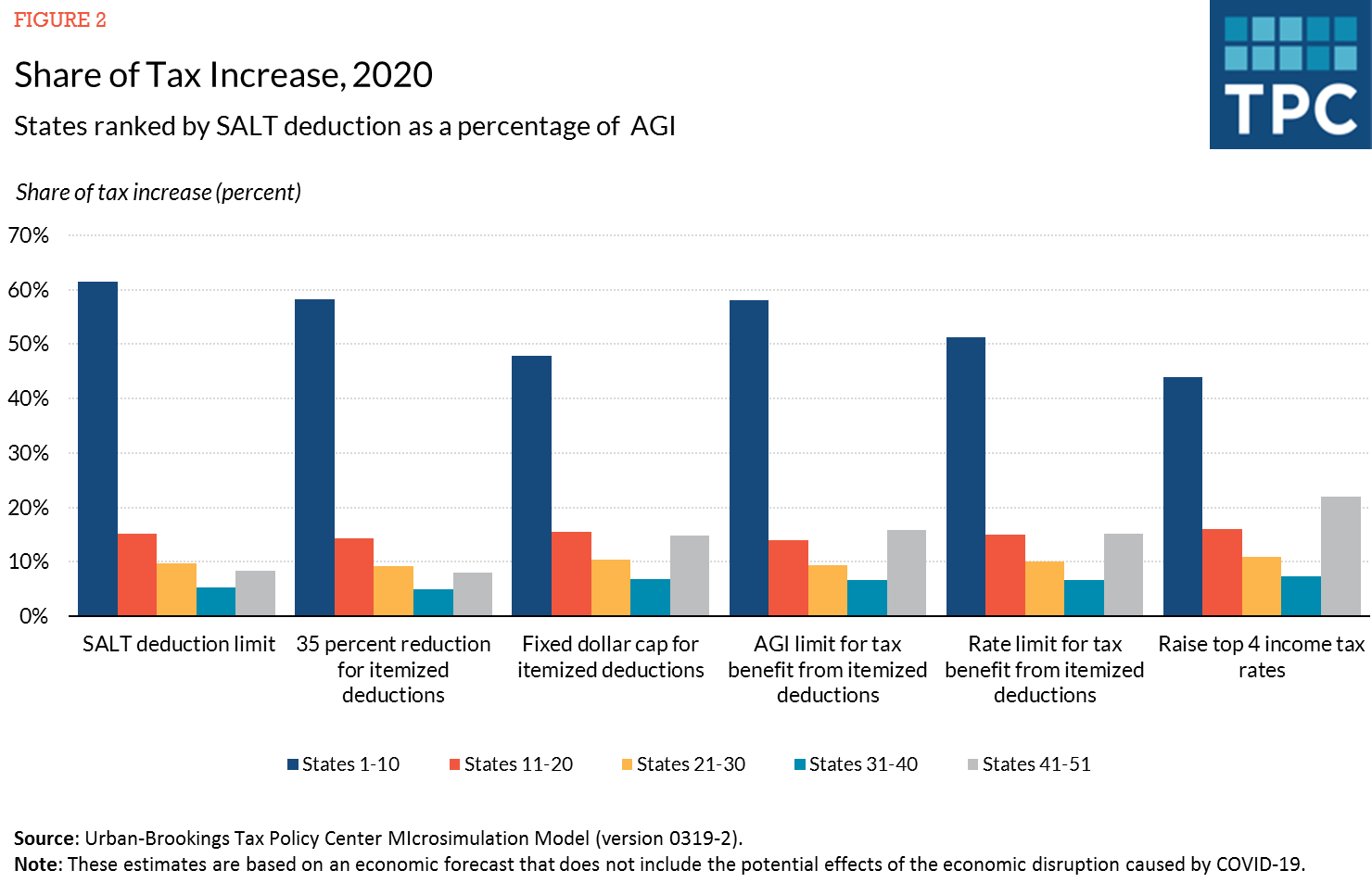

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

How Does The Deduction For State And Local Taxes Work Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Tax Deduction What Is The Salt Deduction Limit Marca

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist